Who is a Revenue Lawyer?

A revenue lawyer deals with cases related to land laws, property taxation, land acquisition, and government revenue regulations. These lawyers help clients resolve disputes with the government, verify land ownership, and ensure smooth property transactions while complying with legal requirements.

Key Areas of Revenue Law

Criminal lawyers deal with a wide range of cases, including:

Why You Need a Revenue Lawyer?

A revenue lawyer ensures:

- ✅ Legal verification of land records.

- ✅ Protection from fraudulent land deals.

- ✅ Assistance in tax disputes and payments.

- ✅ Representation in court for land-related cases.

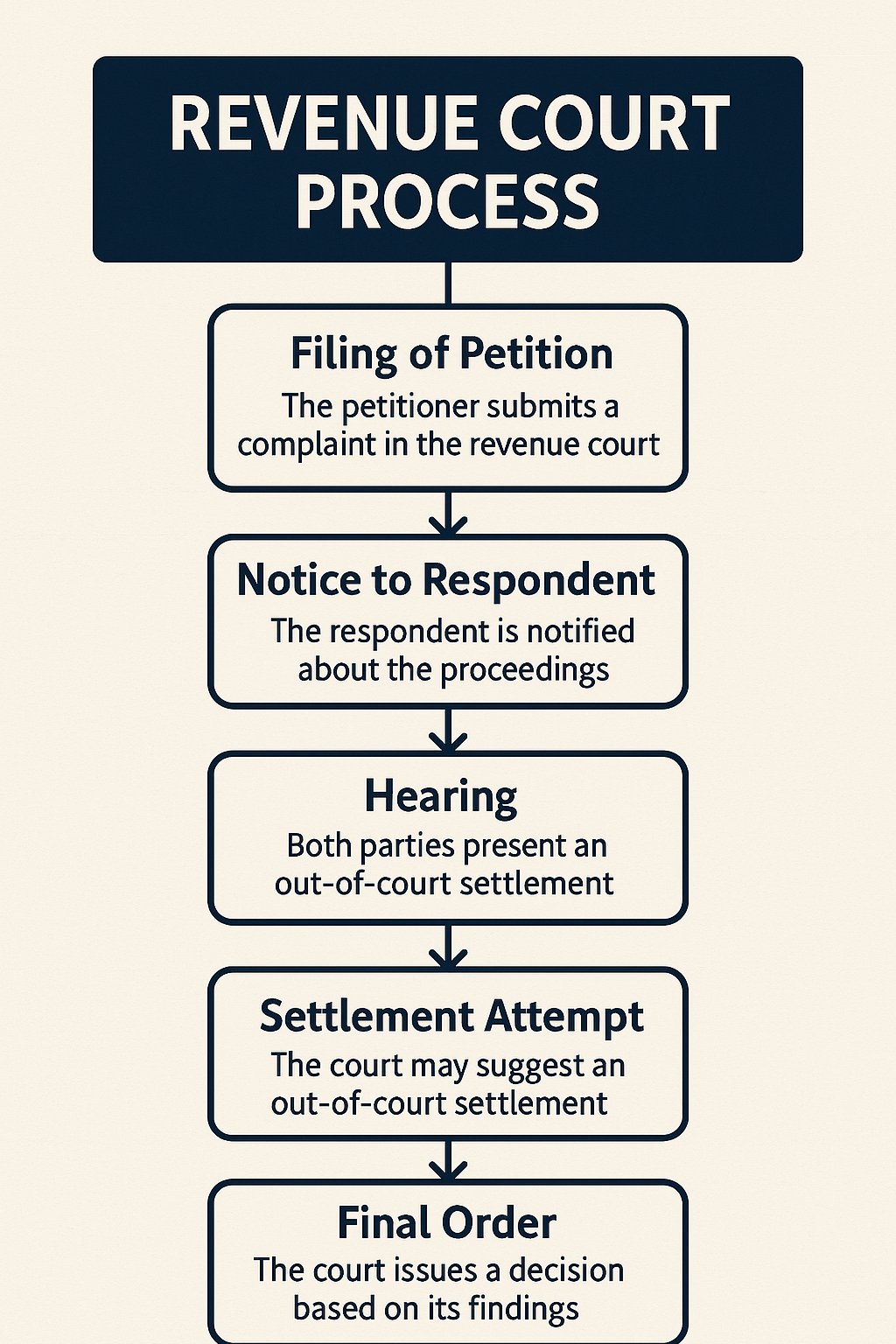

Understanding Revenue Court Procedure in India

A revenue dispute follows these legal steps:

- Filing a Case – The landowner or affected party files a complaint.

- Submission of Documents – Land records and legal papers are reviewed.

- Hearing and Evidence Presentation – Both parties present their claims.

- Court Decision or Settlement – The revenue court issues a verdict or encourages a settlement.

Choosing the Right Revenue Lawyer

When hiring a revenue lawyer, consider:

- Experience in Land and Revenue Law – Specialization in handling land-related cases.

- Familiarity with Local Land Laws – Knowledge of state-specific revenue regulations.

- Reputation and Client Feedback – Positive reviews from previous land dispute cases.

Conclusion

A revenue lawyer is essential for handling land disputes, property taxation, and government-related revenue matters. Whether you’re a landowner, business, or farmer, legal assistance ensures rightful ownership and compliance with revenue laws. Consulting an expert protects your property rights and financial interests.