Who is a Cheque Bounce Lawyer?

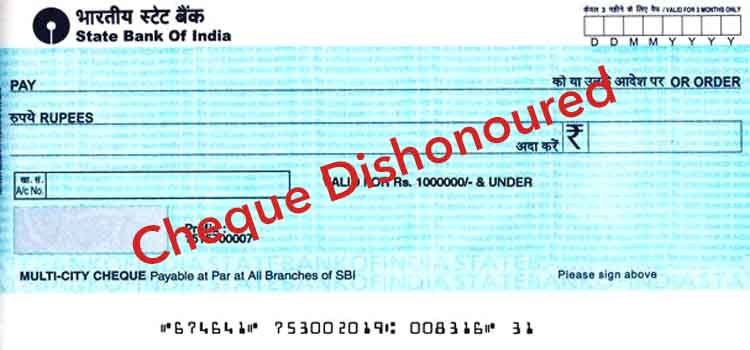

A cheque bounce lawyer specializes in cases where a cheque is dishonored due to insufficient funds, signature mismatch, or account closure. Under Section 138 of the Negotiable Instruments Act, 1881, cheque bouncing is a punishable offense, and legal action can be taken to recover dues.

Key Services Provided by a Cheque Bounce Lawyer

Why You Need a Cheque Bounce Lawyer?

An experienced cheque bounce lawyer ensures:

- ✅ Proper legal documentation for court proceedings.

- ✅ Timely filing of legal notices and cases.

- ✅ Defense against wrongful cheque bounce claims.

- ✅ Assistance in securing compensation or defending financial interests.

Common Reasons for Cheque Bounce Cases

- 1️⃣ Insufficient Funds – The most common reason for cheque dishonor.

- 2️⃣ Signature Mismatch – Discrepancies in the drawer’s signature.

- 3️⃣ Account Closed or Frozen – The cheque is drawn from an inactive account.

- 4️⃣ Incorrect Date or Overwriting – Making the cheque legally invalid.

Legal Consequences of Cheque Bounce in India

A bounced cheque can result in:

- Legal Fines & Compensation: Penalties up to twice the cheque amount.

- Imprisonment: Up to two years of jail in serious cases.

- Bank Blacklisting: Loss of credibility in financial transactions.

How a Cheque Bounce Lawyer Helps in Legal Cases

A cheque bounce lawyer can:

- Draft and send a legally compliant notice to the drawer.

- File a Section 138 complaint in court to recover the amount.

- Negotiate a settlement to avoid lengthy court proceedings.

- Defend against false allegations of cheque dishonor.

Choosing the Right Cheque Bounce Lawyer

When selecting a cheque bounce lawyer, consider:

- Experience in Negotiable Instruments Act Cases – Specialization in Section 138 legal proceedings.

- Successful Case Record – Strong history of winning cheque bounce disputes.

- Expertise in Settlement & Court Representation – Ability to resolve cases efficiently.

Conclusion