Who is an Income Tax/GST Lawyer?

An Income Tax/GST lawyer specializes in tax laws, helping individuals and businesses comply with Income Tax Act, 1961 and Goods and Services Tax (GST) Act, 2017. They assist in tax filings, audits, disputes, and appeals before tax authorities and courts.

Key Services Provided by an Income Tax/GST Lawyer

Why You Need an Income Tax/GST Lawyer?

A tax lawyer ensures:

- ✅ Proper tax compliance to avoid penalties.

- ✅ Legal defense in case of tax disputes.

- ✅ Representation before tax authorities and tribunals.

- ✅ Guidance in tax-saving strategies for businesses and individuals.

Common Tax Issues Handled by a Lawyer

- 1️⃣ Income Tax Notices & Assessments – Handling tax scrutiny and compliance issues.

- 2️⃣ GST Compliance & Disputes – Assisting in GST registration, returns, and audits.

- 3️⃣ Penalty & Fine Reduction – Challenging excessive tax penalties.

- 4️⃣ Tax Raids & Investigations – Legal representation in tax evasion cases.

Legal Remedies for Tax Disputes in India

- Filing Appeals Before Tax Tribunals – Challenging tax orders under Income Tax & GST laws.

- Settlement Before the Tax Settlement Commission – Negotiating tax liabilities.

- Writ Petitions in High Court/Supreme Court – Contesting unfair tax decisions.

How an Income Tax/GST Lawyer Helps in Legal Cases

A skilled tax lawyer can:

- Prevent legal trouble by ensuring proper tax compliance.

- Defend against wrongful tax claims & penalties.

- Assist businesses in optimizing their tax structure.

- Represent clients in high-stakes tax litigation cases.

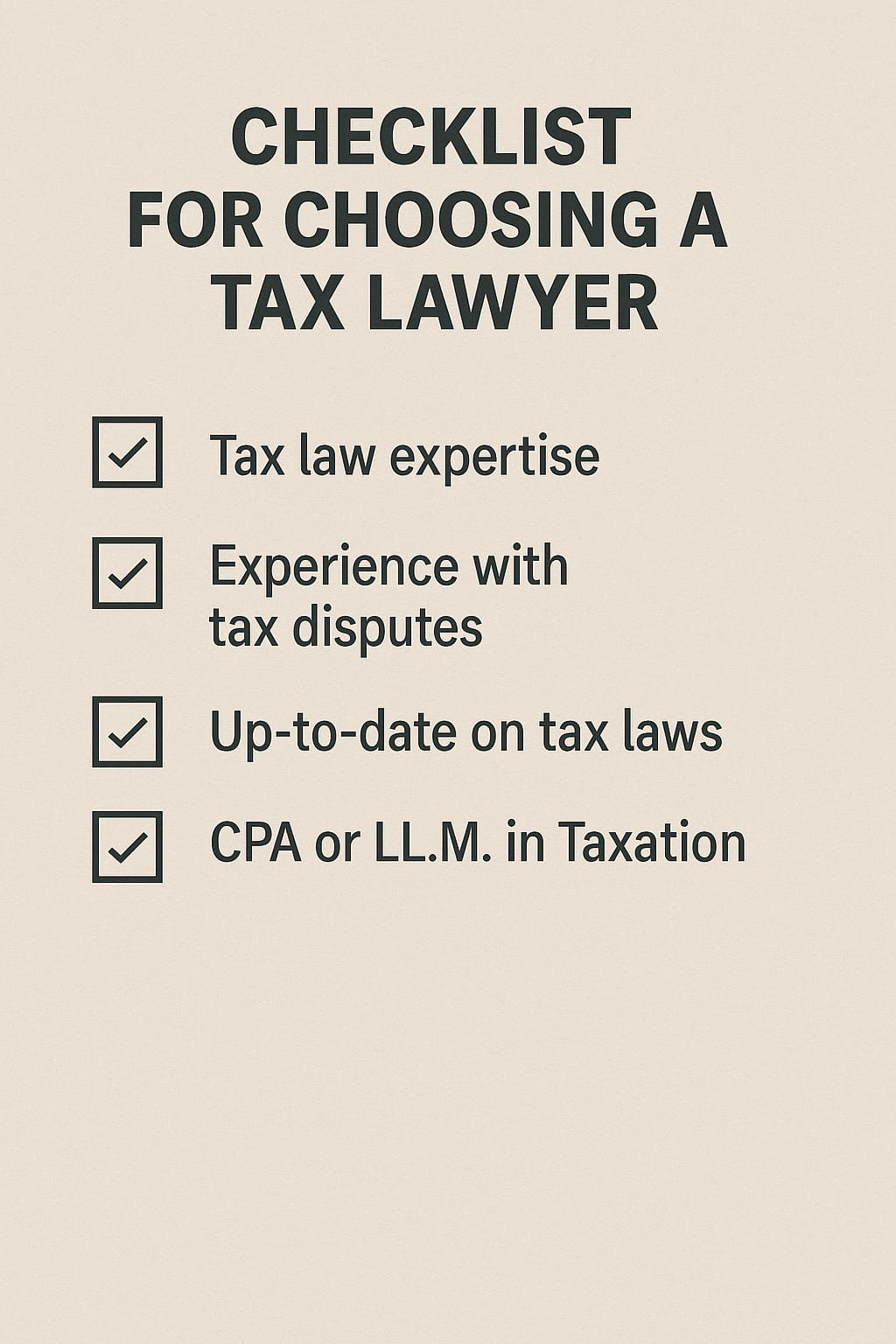

Choosing the Right Income Tax/GST Lawyer

When selecting a tax lawyer, consider:

- Experience in Tax Litigation – Expertise in tax dispute resolution.

- Knowledge of Income Tax & GST Laws – Strong understanding of tax compliance.

- Successful Track Record – Proven ability to reduce tax liabilities.

Conclusion